Shelley Pelkey

Treasurer (ON) Shelley Pelkey has over 25 years of experience as a not-for-profit executive. Previous roles included CEO, Executive Director and Director of Finance with

Archives for Samuel Benoit

Treasurer (ON) Shelley Pelkey has over 25 years of experience as a not-for-profit executive. Previous roles included CEO, Executive Director and Director of Finance with

Director (QC) Zvi is a transportation modelling expert whose interests focus on the linkages between transportation, land use, and sustainable development. His professional experience has

Director (ON) Dave is a dedicated advocate for individuals who have suffered injuries and injustice. Dave is a lawyer who specializes in helping injured cyclists

Director (BC) Eleanor is an experienced charitable sector executive currently serving as the Executive Director for Canadians for Leading Edge Alzheimer Research (CLEAR). She has

Be a part of our national voice for everyday cycling by participating in the Vélo Canada Bikes Annual General Meeting to be held on Sunday,

Do you know someone with legal expertise who shares our vision for a bicycle-friendly Canada? They just might be the person we are looking for

Know a finance professional with a passion for everyday cycling? We are currently seeking applications for a Volunteer Board Treasurer to join us in our

Executive Director (ON) Samuel Benoit is the Executive Director for Vélo Canada Bikes where he is working with our board of directors, members and the

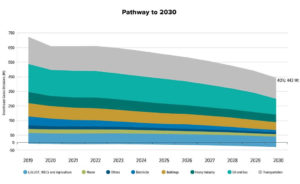

Minister’s Foreword – 2030 Emissions Reduction Plan: Canada’s Next Steps for Clean Air and a Strong Economy On climate action, it is amazing to see

The World Health Organization & United Nations announce Decade of Action for Road Safety Recognizing the importance of the problem and the need to act,

Accessibility Tools